15-25% Ethics, Professional Responsibilities and General Principles

20-30% Assessing Risk and Developing a Planned Response

15-25% Forming Conclusions and Reporting

30-40% Performing Further Procedures and Obtaining Evidence

50% Multiple-Choice Questions

50% Task-Based Simulations

25-35% Conceptual Framework, Standard-Setting

and Financial Reporting

20-30% Select Transactions

30-40% Select Financial Statement Accounts

5-15% State and Local Governments

50% Multiple-Choice Questions

50% Task-Based Simulations

55-85% Federal Taxation

10-20% Business Law

10-20% Ethics, Professional Responsibilities, and Federal Tax Procedures

50% Multiple-Choice Questions

50% Task-Based Simulations

1) Nature and Scope of Audit and Non-Audit Engagements

2) Ethics, Independence and Professional Conduct

3) Terms of Engagement for Audit and Non-Audit Engagements

4) Requirements for Engagements Documentation

5) Communication with Management and Those Charged with Governance

6) Communication with Component Auditors and Parties Other Than Management and Those Charge with Governance

7) A Firm’s System of Quality Control, Including Quality Control at the Engagement Level

1) Planning an Engagement

2) Understanding an Entity and Its Environment

3) Understanding an Entity’s Internal Control

4) Assessing Risks Due to Fraud

5) Identifying and Assessing the Risk of Material Misstatement and Planning Further Procedures Responsive to Identified Risks

6) Materiality

7) Planning for and using the Work of Others, Including Group Audits, the Internal Audit Function and the Work of a Specialist

8) Specific Areas of Audit Risk

1) Reports On Auditing Engagements

2) Reports On Attestation Engagements

3) Accounting and Review Service Engagements

4) Reporting On Compliance

5) Other Reporting Considerations

1) Understanding Sufficient Appropriate Audit Evidence

2) Sampling Techniques

3) Performing Specific Procedures to Obtain Evidence

4) Specific Matters that Require Individual Attention

5) Misstatements and Internal Control Deficiencies

6) Written Representations

7) Subsequent Events and Subsequently Discovered Facts

1) Conceptual framework and standard-setting

2) General-purpose financial statements: for-profit business entities

3) General-purpose financial statements: nongovernmental, not-for-profit entities

4) Public company reporting topics

5) Financial statements of employee benefit plans

6) Special purpose frameworks

1) State and local government concepts

2) Format and content of the Comprehensive Annual Financial Report (CAFR)

3) Deriving government-wide financial statements and reconciliation requirements

4) Typical items and specific types of transactions and events in governmental entity financial statements

1) Accounting changes and error corrections

2) Business combinations

3) Contingencies and commitments

4) Derivatives and hedge accounting

5) Foreign currency transactions and translation

6) Leases

7) Nonreciprocal transfers

8) Research and development costs

9) Software costs

10) Subsequent events

11) Fair value measurements

1) Cash and cash equivalents

2) Trade receivables

3) Inventory

4) Property, plant and equipment

5) Investments

6) Intangible assets

7) Payables and accrued liabilities

8) Long-term debt

9) Equity

10) Revenue recognition

11) Compensation and benefits

12) Income taxes

1) Federal taxation of individuals

2) Federal taxation of entities

3) Federal taxation of property transactions

1) Ethics and responsibilities in tax practice

2) Licensing and disciplinary systems

3) Federal tax procedures

4) Legal duties and responsibilities

1) Contracts

2) Agency

3) Business structure

4) Debtor-creditor relationships

5) Government regulation of business

|

QUARTER

|

CORE TEST DATES

|

CORE SCORE REPORTS

|

DISCIPLINE TEST DATES

|

DISCIPLINE SCORE REPORTS

|

|---|---|---|---|---|

|

24Q1

|

JAN 10 - MAR 26

|

JUN 4

|

JAN10-FEB 6

|

APR 24

|

|

24Q2

|

APR 1 - JUN 25

|

JULY 31

|

APRIL 20 - MAY 19

|

JUN 28

|

|

24Q3

|

JUL 1 - SEP 25

|

APPROX NOV 1

|

JULY 1 - 31

|

SEP 10

|

|

24Q4

|

OCT 1 - DEC 26

|

EARLY FEB 2025**

|

OCT 1 - 31

|

DEC 10

|

|

QUARTER

|

CORE TEST DATES

|

CORE SCORE REPORTS

|

DISCIPLINE TEST DATES

|

DISCIPLINE SCORE REPORTS

|

|---|---|---|---|---|

|

24Q1

|

JAN 10 - MAR 26

|

JUN 4

|

JAN10-FEB 6

|

APR 24

|

|

24Q2

|

APR 1 - JUN 25

|

JULY 31

|

APRIL 20 - MAY 19

|

JUN 28

|

|

24Q3

|

JUL 1 - SEP 25

|

APPROX NOV 1

|

JULY 1 - 31

|

SEP 10

|

|

24Q4

|

OCT 1 - DEC 26

|

EARLY FEB 2025**

|

OCT 1 - 31

|

DEC 10

|

Address: 7th KEK Towers CV Raman Pillai Road Opp trivandrum club Vazhuthacaud, Palayam, Thiruvananthapuram, Kerala 695010

‘US CPA’ (Certified Public Accountant) is a highly sought-after designation because not only is it recognized in most countries around the globe – including the US, Canada and Australia but also because experienced US CPAs tend to climb the corporate ladder relatively easily due to the practical & industry-focused content of the US CPA curriculum.

The scope of US CPA (Certified Public Accountant) in India is primarily focused on international accounting and finance roles. US CPAs are sought after by multinational corporations, audit firms, and financial institutions operating in India for their expertise in U.S. GAAP and international accounting standards, as well as their ability to navigate complex financial regulations and compliance requirements.

US CPA Course has a usual run-time of 1 year i.e. 12 months for most people. If you are a full-time student, you may be able to complete the US CPA training & exams in less than a year. For working professionals who may not be able to dedicate study time on a daily basis, completing US CPA can take up to 18 Months or 1.5 years.

Starting Jan 1, 2024, the US CPA exam follows a 3+1 pattern i.e. 3 core subjects and 1 elective specialization. The core US CPA subjects are 1. AUDIT & ATTESTAION; 2. US TAX REGULATION & BUSINESS LAWS; 3. FINANCIAL ACCOUNTING & REPORTING.

The average starting salary for US CPAs in India is INR 8-10 LPA, based on US CPA License Application status, location and employer.

US CPA Exams are on-demand and do not follow a fixed schedule. Exams are available all year round in India and you can be scheduled in any order on any day (except public holidays) based on your preferences and preparation level at a time slot of your choice.

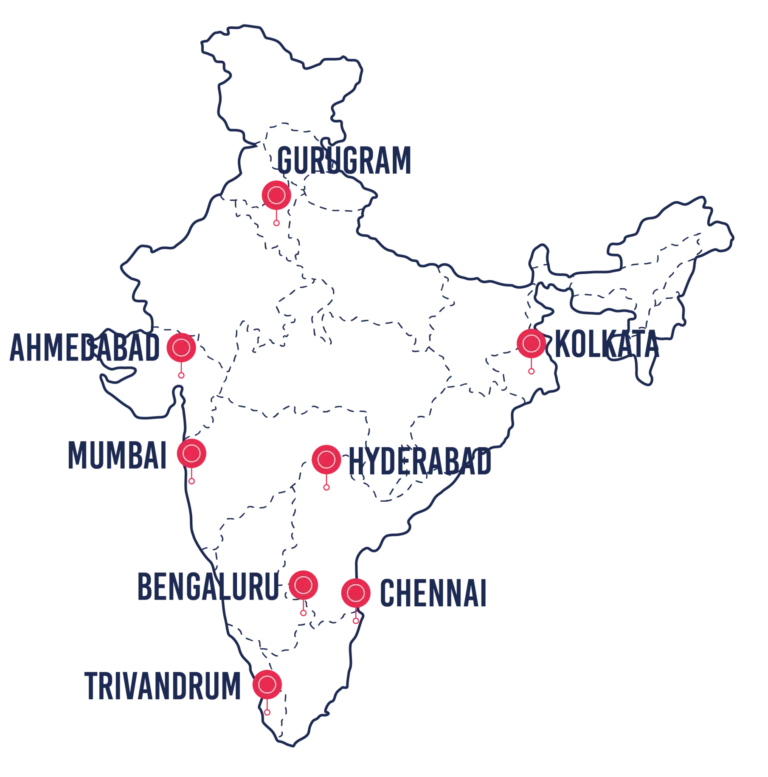

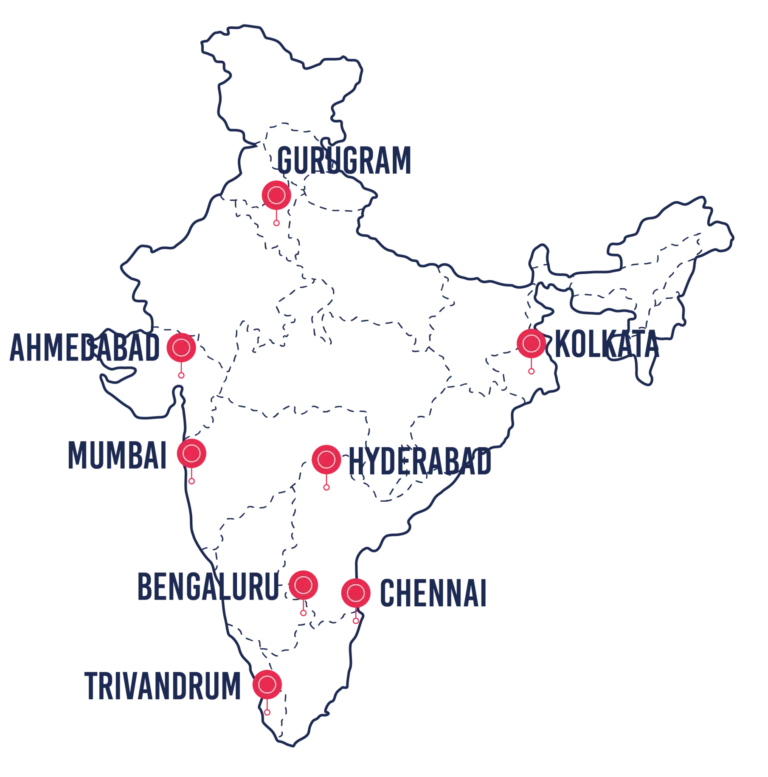

US CPA Exams are conducted at Prometric Centres located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum, in India.

Yes, while our US CPA online course helps you understand the ins and outs of the exam, our academic team will also help you select a State Board of Accountancy most appropriate for you.

Yes, our online US CPA coaching trains you for all four exams – Audit, Financial Accounting & Reporting, Regulation, and Business Environment & Concepts. Moreover, our comprehensive US CPA USA course also comes with unlimited access to Wiley study material.

At EduMont, we offer you complete transparency in everything; be it information about the US CPA course, duration, US CPA exam fee, syllabus or the registration process.

The purpose of the US CPA (Certified Public Accountant) certification is to ensure that professionals in accounting and finance possess the knowledge, skills, and ethical standards required for roles in auditing, financial reporting, taxation, and consulting. It signifies a high level of expertise, credibility, and adherence to professional standards in the field of accounting.

You can get access to the 2024 US CPA Syllabus and all the necessary updates on the US CPA Evolution Model at the NASBA & AICPA websites or simply google AICPA Exam Blueprints and download the pdf from official AICPA website.

EduMont provides comprehensive & interactive live CPA classes, quick doubt resolution, AICPA Approved CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

AICPA Approved Study Materials are the best choice for students wanting to clear the US CPA Exam in 1 Attempt. Approved content goes thorough rigorous quality checks by AICPA and conform with the official US CPA Syllabus. AICPA Approved content also auto updates with the latest topics once they are released and added to the US CPA syllabus by AICPA. There are only 5 Approved Study Materials: UWorld, ROGER’s, Surgent, Beckers & Gliem, any other providers/names, are not approved by AICPA (no matter what they say or advertise). Please beware!

EduMont provides comprehensive & interactive live US CPA classes, quick doubt resolution, AICPA Approved US CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian US CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

EduMont provides comprehensive & interactive live US CPA classes, quick doubt resolution, AICPA Approved US CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian US CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

UWorld CPA Excel is an Approved US CPA Study Material, as is the Beckers US CPA Package & Review. Both have the similar content of equal quality. However, while Becker’s in India comes with limited access only, whereas WILEY comes with unlimited access as standard. This means with Beckers there are hidden charges for renewal fees everytime your access needs to be renewed. But with WILEY, you own the US CPA study materials till you become a US CPA, with no renewal fee/hidden charges and automatic over the air updates for future syllabus changes. Given these facts WILEY is clearly the wiser choice.

The following areas are serviceable at EduMont: US CPA classes in Delhi, US CPA classes in Noida, US CPA classes in Mumbai, US CPA classes in Pune, US CPA classes in Hyderabad, CPA classes in Ahmedabad, US CPA classes in Bangalore and all other major cities across India. Our students trust us for US CPA Coaching in Delhi, US CPA Coaching in Noida, US CPA Coaching in Mumbai, US CPA Coaching in Pune, US CPA Coaching in Hyderabad, US CPA Coaching in Ahmedabad, US CPA Coaching in Bangalore and all other major cities across India.

The total cost of doing US CPA in India (including US CPA Registration Fees in India, AICPA Approved study materials, coaching and all the necessary US CPA Exam Fees) is INR 3,45,482. For a more detailed breakdown of the costs refer to the CPA Fee section above.

©2021. EduMont Classes ALL RIGHTS RESERVED.