Best CPA Exam Review Courses in 2026 – Complete Comparison & Buying Guide

Many CPA candidates do not fail due to a lack of ability, but because they picked a course that clashes with their schedule and learning style. It’s very important to select the right CPA review course, especially when time is limited, and the financial investment is sizable. This is exactly why identifying the best CPA exam review courses for your situation matters.

Selecting the right CPA exam review course is a critical step in your CPA journey. It not only affects your understanding of the syllabus, but also affects how cleverly you save your time and money and avoid mental exhaustion throughout all four sections. A well-matched course from the top CPA prep courses available today can significantly reduce unnecessary stress and retakes.

Among the numerous top CPA prep courses like UWorld, Becker, Surgent, Gleim, Ninja, and India-Alligned Course Providers that advertise high pass rates, adaptive learning, and guarantees, one can easily get confused with their options, especially if you are a working professional, an international student, or a student on a limited budget. This is where objective CPA course reviews become essential.

That confusion is exactly why this guide exists.

Why This Guide?

This guide will give you a detailed CPA review course comparison backed up with data, a pricing overview of all the leading course materials, a sincere description of the advantages and disadvantages based on the actual usage patterns, and an 8-week study plan for you to follow, along with a few personal insights from our experts. It is designed to help you identify not just premium options, but also affordable CPA review solutions that still deliver results.

The majority of CPA course reviews online tend to be either too promotional listicles without any actual numbers, or they are outdated comparisons that neglect international learners and working professionals

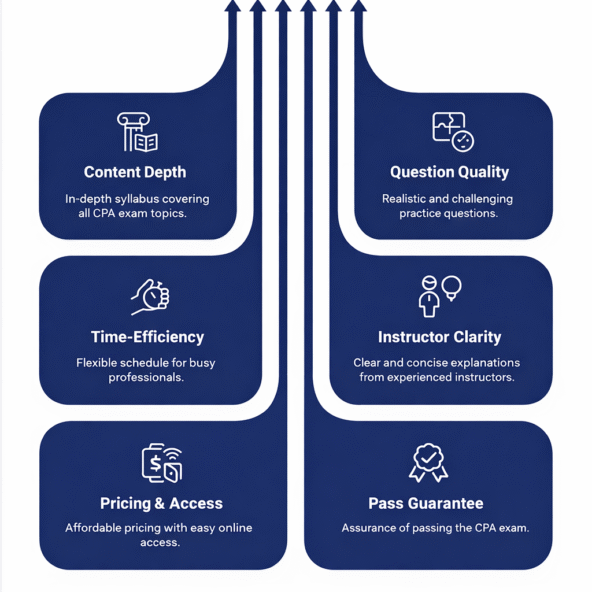

This guide is here to enable you to make the right choice and pass on your first attempt. During our analysis, we’ve focused on what truly matters while selecting the CPA course prep; these factors include:

- Question quality (not only quantity)

- Learning efficiency

- Access flexibility

- CPA Cost vs value

- Support for working professionals studying

These criteria form the backbone of our CPA course review comparison methodology.

How to Pick the Best CPA Exam Review Course (EduMont’s Ranking Criteria)

We evaluated each course using the following criteria, based on what actually impacts CPA outcomes and long-term success with the best CPA exam review courses:

- Content Depth and Syllabus Coverage: Both of these factors are key to long-term exam readiness. Besides going surface-level teaching, a US CPA course should closely follow the CPA syllabus to help first-time candidates, especially international ones, pass.

- Practice Question Quality: More than the number of questions of the Test Bank, it is the high-quality, exam-level questions with detailed explanations that develop better judgment and assessment-based reasoning than larger but shallow question banks, which is consistently highlighted in licensed and AICPA-approved course reviews.

- Working Professionals Can Efficiently Use Their Study Time: With an adaptive learning system, test takers can identify weak areas at the very beginning and constantly adjust study plans, courses that do this minimise efforts and are perfectly suitable for candidates who are juggling jobs and studies.

- Instructor Clarity Is Essential: For Indian, international, and foreign non-US accounting background candidates, having a thorough understanding of the concept-first teaching will help them bridge the gap between Indian accounting education and US CPA exam expectations.

- Pricing and Access Duration: What matters more than headline discounts to candidates preparing alongside work are transparent pricing, longer access periods, and fair extension policies, especially when comparing affordable CPA review options.

- Pass Guarantees and Support Systems: The passing guarantees and the system support must be practical, not just promotional. Simply put, a genuine passing on one attempt guarantees academic guidance and recovery support, besides very difficult refund conditions.

- Structured Evaluation Framework: This helps reduce confusion and increase decision-making. By deciding ahead on clear criteria, candidates refrain from being influenced by rankings, ads, or peer pressure and choose calmly and confidently from the top licensed and reliable CPA prep courses available.

Top CPA Review Courses – EduMont Quick Picks (2026)

Choosing a CPA review course is an important decision from both an academic and financial standpoint, especially when narrowing down the best CPA exam review courses for your profile.

In order to make the right choice, one has to take into account several personal factors such as career goal (Big-4 vs industry), study timeline, budget, and the fact whether one is preparing for the exam from India or overseas.

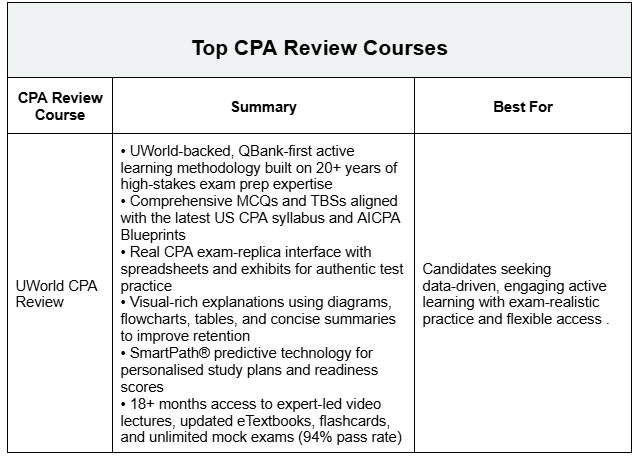

Presented below is a table that thoroughly and clearly compares a number of widely used CPA review courses globally. This quick-view CPA review course comparison highlights both premium and affordable CPA review options. The summary listing of courses explains each one by showing:

- Where the course has its main strength

- What kind of candidate is it best suited for

This is intended to help you realistically filter your options before you decide on the cost of the course material, access duration, mentoring support, and study plans in detail.

EduMont’s In-depth Provider Reviews

1. UWorld CPA Review

Overview

UWorld CPA Review is built on the combined academic depth of Wiley and the teaching clarity of Roger CPA Review, making it one of the most conceptually strong and exam-relevant platforms available today. The course is designed to help students truly understand CPA concepts, not just memorise answers.

UWorld’s CPA Review offers full-length adaptive learning mock exams that closely replicate the real CPA exam experience in terms of interface, structure, and timing. Designed to mirror the Prometric testing environment, which is licensed by the AICPA, these simulations include exam-style multiple-choice questions and task-based simulations with balanced difficulty. Practising with these realistic mocks helps candidates build exam-day stamina, improve time management, and walk into the actual exam with greater confidence and familiarity.

Making it suitable for both first-time test takers and repeat candidates. Its strength lies in how it teaches why an answer is correct, closely mirroring the AICPA exam mindset.

Who It’s Best For:

Students who want strong conceptual clarity, high-quality practice, and realistic exam simulations, while still maintaining flexibility in pace, especially working professionals and international CPA candidates.

Pros

Here are the biggest pros of UWorld CPA Review – clear, outcome-focused, and easy to include in your copy or table:

Biggest Pros of UWorld CPA Review

- Proven Active-Learning Methodology

Uses a QBank-first, learn-by-doing approach that builds deep understanding rather than superficial memorisation. - Real Exam Simulation

Practice questions and task-based simulations in an interface that closely mimics the actual US CPA Exam, including spreadsheets and exhibits. - Comprehensive & Up-to-Date Content

Extensive coverage of MCQs and TBSs aligned with the current CPA syllabus and AICPA Blueprints. - Visual-Rich Explanations

Illustrations, diagrams, flowcharts, and tables make complex concepts easier to grasp and retain. - SmartPath Tool

SmartPath predictive technology creates customised study plans and readiness scores to keep you focused and efficient. - Premium Study Resources

Includes expert-led video lectures, updated eTextbooks with search/highlight tools, flashcards, performance analytics, and unlimited mock exams. - Strong Track Record

Built on UWorld’s 20+ years of success helping candidates in high-stakes exams, with a high CPA pass rate as an outcome indicator.

Cons

- Feature sets can vary depending on the bundle selected

- Less dependent on brand-led hiring perception, with a stronger emphasis on concept mastery and exam performance rather than employer-driven signalling.

- Students must clearly understand what’s included in their chosen package before enrolling

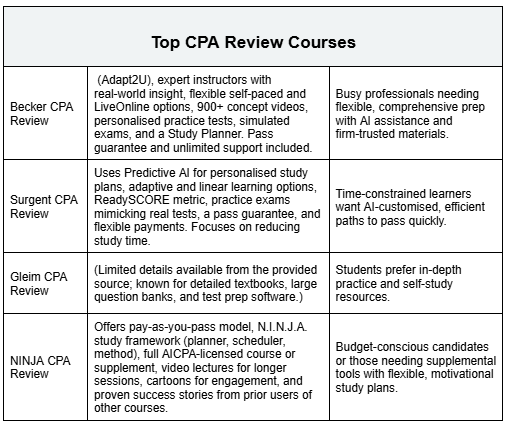

2. Becker CPA Review

Overview

Becker is one of the most widely recognised CPA review providers globally and is often considered the “default choice” among Big-4 firms and large multinational employers. The platform is known for its highly structured study plan, extensive video lectures, and close alignment with the CPA exam blueprint.

Who It’s Best For:

Students targeting Big-4 or multinational firms who want maximum structure, brand recognition, and a guided, premium preparation experience.

Pros

- Strong brand recognition with Big-4 and global firms

- A large volume of video lectures and practice questions

Cons

- Heavy content load can feel overwhelming for many students

- Higher pricing compared to most alternatives

- Limited flexibility for selective or fast-track learners

- Time-bound access may require costly renewals

3. Surgent CPA Review

Overview

Surgent CPA Review is built around adaptive learning technology. Instead of covering the entire syllabus in sequence, Surgent identifies a student’s weak areas and prioritises them, helping reduce unnecessary study time.

Who It’s Best For:

Working professionals who want fast, focused preparation and are comfortable learning independently with technology-led guidance.

Pros

- Adaptive technology targets weak areas efficiently

- Reduces overall study time

Cons

- Less depth in conceptual explanations

- Requires high self-discipline

- Minimal instructor-led guidance

- Not ideal for beginners who need step-by-step teaching

3. Gleim CPA Review

Overview

Gleim is known for its depth and volume. It offers large CPA question banks available, along with highly detailed study materials. The course is designed for students who prefer exhaustive coverage and repeated reinforcement. Gleim follows a more traditional learning approach and rewards consistent, methodical study over quick shortcuts.

Who It’s Best For:

Students who prefer deep, independent study, especially repeat candidates or those who want unlimited access without time pressure.

Pros

- Extremely large and comprehensive question bank

- “Until you pass”, access reduces deadline stress

Cons

- Very content-heavy and time-intensive

- Platform feels more traditional and less modern

- Limited adaptive or AI-driven personalisation

4. NINJA CPA Review

Overview

NINJA CPA Review is primarily a supplementary tool, not a full-scale, standalone course. It focuses on affordable MCQ practice, audio learning, and short-term revision support, often used alongside another primary CPA review provider.

Who It’s Best For:

Students who already have a main CPA course and want low-cost extra practice or last-stage revision.

Pros

- Strong MCQ bank for revision and audio lectures are useful for passive learning

- Flexible, short-term access

Cons

- Not comprehensive as a standalone course

- Limited conceptual teaching

- Minimal structure or guided study plan

Comparison Matrix: Top CPA Review Courses 2026

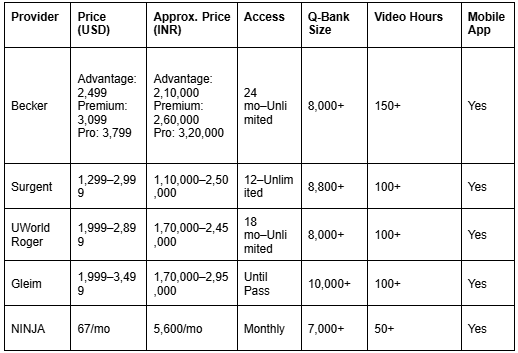

Here is a comparison chart covering pricing, access duration, and core learning features of popular CPA review courses on both international platforms as well as India-centric options.

In order to facilitate comparison for candidates located in India, the prices shown are in USD as well as their approximate INR equivalents. Please keep in mind that:

- The INR numbers are just a guide, and the actual figures can vary due to changes in the exchange rate, local offers or school partnerships.

- Access means the availability period of the course materials starting from the enrolment date.

- The size of the question bank and the number of video hours represent the depth of content, not the pace of learning.

Here From Our Students

Which CPA Review Course Is Best for You?

The “best” CPA review course is determined lesser by the brand name and more by your background, work schedule, and learning style. Here is a simple way to decide.

- For Working Professionals: When CPA preparation is one of the items on your to-do list, along with a full-time job, then an efficient course is more helpful than one with lots of materials. UWorld, for instance, if combined with structured mentoring, can be a great choice with its adaptive interface, as it allows you to concentrate only on your weak points rather than re-studying everything. If you follow the appropriate plan, even 1-2 sharply focused hours a day can be sufficient.

- For Big-4 Aspirants

If, in the future, you plan to work for a Big-4 or a large global accounting firm, then Becker is still the most suitable option to consider, along with UWorld. Its methodical arrangement, practice exams in the style of the real ones, and employer recognition make it a very suitable product for those who want a structured, top-down approach and are comfortable spending on a premium solution.

- For Budget-Conscious Learners

If you are into saving money, then NINJA CPA Review can either be a decent first step or a strong supplement. But the budget options are the best when they are accompanied by clear guidance and accountability. However, Low-cost courses may become too disruptive or underutilised if there is no structured mentoring.

8-Week Sample CPA Study Plan

It is a typical error of CPA aspirants to proceed blindly. Here is a practical 8-week structure that a lot of working professionals use to get the ball rolling.

Weeks 1-2: Groundwork & Reference: The first task is to do a diagnostic test that will reveal your knowledge level. It allows for a more efficient syllabus planning, early spotting of the weak points, and a realistic study tempo setting in accordance with your working hours.

Weeks 3-6: Understanding & Memorising: During this time, you study the main topics and challenge yourself with multiple-choice questions. Instead of passively watching, the focus is on actively practising and revising, which enhances memory and builds confidence.

Weeks 7-8: Get Set for the Exam: This stage involves taking complete practice tests, evaluating your results, and reviewing material. It is also the perfect time to develop exam temperament, time management, and accuracy.

EduMont Recommendation and Support

Most CPA students do not fail because of having bad study materials. Rather, they face real-world issues like no proper plan, burnout due to overwhelming, directionless studying hours, and difficulty in implementing the concepts under exam pressure.

To address these challenges, EduMont recommends and supports UWorld CPA Review, a platform designed not just to provide content, but to guide students toward effective, exam-ready preparation.

What UWorld Offers

- Unlimited Access Until You Pass

Flexible learning with continued access ensures mastery and confidence, backed by UWorld’s 20+ years of high-stakes exam prep success and a proven high CPA pass rate. - Performance Adaptive Simulation

Practice MCQs and task-based simulations in an interface that mirrors the actual US CPA Exam, including spreadsheets and exhibits. - SmartPath Predictive Technology

Creates personalised study plans, readiness scores, and performance comparisons against other candidates for strategic, efficient preparation. - Comprehensive & Up-to-Date Content

Covers all core and specialisation subjects with 8,000+ high-quality questions aligned with the AICPA-licensed syllabus and Blueprints. - Premium Study Resources

Includes expert-led video lectures, updated digital and physical textbooks, flashcards, unlimited mock exams, and performance analytics for complete preparation. - Visual-Rich Explanations & Analytics

Illustrations, flowcharts, diagrams, and tables simplify complex concepts, while statistical performance data tracks your conceptual understanding and highlights areas for improvement. - Proven Active-Learning Methodology

QBank-first, learn-by-doing approach that builds deep understanding instead of rote memorisation.

According to statistics: Learners benefiting from UWorld’s adaptive features have better results as they can immediately focus on their weaker areas.

What EduMont Offers

EduMont provides CPA aspirants with a structured, student-centric preparation framework that is designed to help candidates pass the US CPA exam in a single attempt. The program combines high-quality resources, personalised guidance, and expert instruction to ensure thorough readiness. Key features include:

- Unlimited Access to UWorld Resources: Students benefit from unrestricted access to UWorld’s printed study materials, eBooks, question banks, and unlimited mock exams, enabling efficient learning and practice until mastery is achieved.

- Live Chalk-and-Talk Classes: Interactive sessions allow for real-time doubt resolution, helping students grasp complex concepts effectively and clarifying any queries immediately.

- EduMont Learning Management System (LMS) Access: Candidates can access pre-annotated, highlighted study materials, class notes, and recorded lectures, with availability continuing until they successfully pass the exam.

- Certified Faculty-Led Training: Instruction is delivered by highly experienced professionals, including CPA/CMA-certified instructors and TEDx speaker Rohan Chopra, as well as expert CPA faculty such as Shubham Shandilya and Parth Zaveri, ensuring high-quality teaching and guidance.

- Safety Net System: EduMont tracks candidate progress continuously and offers intervention and personalised support. This ensures candidates attempt each CPA section only when fully prepared, maximising the likelihood of success.

- Personalised One-on-One Game Plan Calls: Mentorship sessions evaluate each student’s preparation, customise their exam strategy, and provide guidance designed to help candidates pass without needing retakes.

- Pass-in-One-Attempt Guarantee: The Game Plan Call evaluation system underpins this promise, giving students confidence in their preparation and approach.

- End-to-End Enrolment and Career Support: EduMont assists students throughout the entire CPA journey, from eligibility checks and scheduling exams to career guidance and placement support, ensuring a smooth path from preparation to licensure.

- No-Cost EMI Assistance: Flexible payment options are provided to ensure that financial constraints never hinder learning, making world-class CPA preparation accessible to everyone.

More than 85% of our mentees are able to have momentum throughout and make you pass in 1st attempt only- because we understand the juggling between work and preparation.

What Makes This Duo The Best

- They offer you practice of the highest standard (UWorld) + well-structured guidance

- The progression is smart, just gradual – no overload.

- They provide support that is perfect for busy professionals like you, thus cutting down on time and CPA re-examination costs (average CPA retake: $1,500+ USD).

- Learn efficiently, be regular in your efforts and be sure to pass the first time.

Conclusion

When deciding on a CPA review course, it’s really about who has the content, planning and support most suited to your needs rather than which one is the most popular or expensive. At EduMont, we are committed to guiding you through the process of making the right decisions, preparing adequately and passing the CPA exam successfully with ‘No Retakes and Just Results’.

You shouldn’t delay your next step any longer: talk to an EduMont consultant to get personalised advice, make the best choices based on your eligibility and have a complete CPA plan tailored to your career and working hours.

Check your Free Eligibility today and embark on your CPA journey with clarity and confidence.

Frequently Asked Questions

- Can I prepare for the CPA exam from India while working full-time?

Yes. Many candidates do. The key is choosing the right course, following a realistic plan, and avoiding burnout by overloading your schedule.

- Is Becker mandatory if I want to join a Big-4 firm?

No course is mandatory. Becker is popular among Big-4 aspirants because of its structure and recognition, but other combinations can work just as well with proper planning.

- How long does CPA preparation usually take?

For most working professionals, CPA prep takes 12 to 18 months, depending on the number of hours you can consistently dedicate each week.

- Are lower-cost CPA review courses risky?

Not necessarily. They become risky only when used without structure, planning, or support. Content alone does not guarantee success.

- Do I need coaching, or is a review course enough?

Most CPA failures happen due to poor planning and inconsistency-not lack of content. Coaching or mentoring helps bridge that gap by keeping you accountable and focused.

- How do I choose an affordable CPA review course without compromising quality?

Many candidates worry that lower-cost options mean lower quality. The key is to evaluate courses based on question quality, syllabus coverage, and support rather than just price.