CFA vs CPA: Which One Should You Choose in 2026?

Truth-first comparison. No retakes. Just results.

At EduMont, after coaching thousands of Indian professionals handling U.S. clients, Big 4 audits, and global investment teams, I see one recurring question in my cabin:

“Rohan sir, is CFA better for me or CPA?”

Most students think this is a difficult choice—but only if you compare them superficially. They look at pass rates and exam fees and get stuck. But that’s the wrong way to look at it.

The real choice isn’t about the exam. It’s about the work you want to do for the next 20 years. Once you evaluate your background + strengths + long-term goals, the answer becomes clear.

In this guide, I’m giving you the deep dive you need—covering the 2025 syllabus changes, the new salary benchmarks in India, and the real ROI of both paths.

Quick Rule of Choice

If you are in a hurry, use this rule of thumb.

- Choose CFA if you love markets, valuation, investments, risk, and strategy. You want to look at a company and predict where it will be in 10 years.

- Choose CPA if you prefer accounting, reporting, audit, tax, and corporate finance. You want to look at a company and verify exactly where it stands today.

Which makes more money?

- CFA = Higher long-term upside (variable pay and bonuses in investments can be huge).

- CPA = Faster completion + stable, predictable demand (recession-proof and high starting salaries).

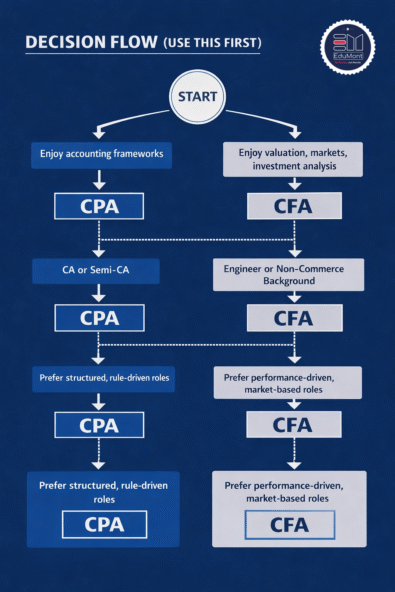

The Decision Flow: How to Decide in 2 Minutes

Don’t guess. Look at your natural strengths. Use this logic flow to filter yourself out immediately.

INFOGRAPHIC: Decision Flowchart

Design Note: Create a vertical flowchart visual with these steps.

Step 1: What do you enjoy?

- “I enjoy accounting frameworks, logic, and balancing numbers.” → Go to CPA

- “I enjoy analyzing markets, predicting trends, and managing risk.” → Go to CFA

Step 2: What is your background?

- CA / Semi-CA / B.Com: You already have the accounting base. CPA is the quickest win. → CPA

- Engineer / Non-Commerce: You have strong math skills but no accounting habits to “unlearn.” CFA is a great fresh start. → CFA

Step 3: What is your work personality?

- Structured: You like clear rules (IFRS/GAAP) and defined processes. → CPA

- Performance-Driven: You like high-stakes decision-making where the “right” answer changes daily. → CFA

What Is CFA? (The Investment Track)

The Chartered Financial Analyst (CFA) credential (awarded by CFA Institute, USA) is the global gold standard for investment careers. It is not just a degree; it is a signal to the market that you understand how money works.

- Who is it for? Aspirants for Investment Banking (IB), Equity Research, Portfolio Management, Wealth Management, or Risk.

- The Vibe: Analytical, decision-driven, high-pressure, intellectual.

Deep Dive: The Syllabus (It’s a Marathon)

Many students underestimate the sheer depth of the CFA curriculum. It’s not just about memorizing formulas; it’s about application.

- Level 1 (The Foundation): Focuses on “Investment Tools.” You cover Ethics, Quant, Economics, and Financial Reporting.

- Rohan Sir’s Note: Ethics is the “silent killer.” You can ace Quant, but if you fail Ethics, you fail the exam.

- Level 2 (The Valuation Beast): Arguably the hardest level. You stop defining terms and start valuing assets. You will build models for Equity, Fixed Income, and Derivatives.

- Level 3 (The Portfolio Manager): Tests synthesis. How do you manage a client’s wealth? It includes “constructed response” (essay) questions that test your judgment, not just your memory.

The Practical Reality: A Day in the Life

Role: Equity Research Analyst at a Global Bank (Mumbai)

It’s 8:00 AM. You are tracking a listed Pharma company. They just announced a failed drug trial, and the stock is down 8%. Your job isn’t just to report the news. You have to open your Excel valuation model, stress-test your revenue assumptions for 2027, and decide: Is this a buying opportunity or a falling knife? By 10:00 AM, you pitch your “Buy” recommendation to the Fund Manager. If you’re right, the fund makes millions. It is high-stress, high-reward work.

What Is CPA? (The Accounting Track)

The U.S. Certified Public Accountant (CPA) credential (awarded by U.S. State Boards) is the highest accounting qualification in the US. In India, it is currently the most “in-demand” qualification for professionals working in US-based MNCs, Big 4s, and Global Capability Centers (GCCs).

- Who is it for? Aspirants for Audit, Tax, Financial Reporting, Controllership, or FP&A.

- The Vibe: Structured, logical, rule-based (US GAAP/IFRS), stable, respectful.

Deep Dive: The New CPA Evolution (2024 Update)

The CPA exam has transformed. It now follows a Core + Discipline model, allowing you to specialize early.

- The Core (Everyone takes these 3):

- FAR (Financial Accounting & Reporting): The “beast” of the exam. Covers US GAAP, Non-Profit, and Government accounting.

- AUD (Auditing & Attestation): Focuses on logic, internal controls, and verification.

- REG (Regulation): U.S. Tax law and business law.

- The Disciplines (Choose ONE):

- BAR (Business Analysis and Reporting): For technical accounting and data analysis.

- ISC (Information Systems and Controls): For those interested in IT Audit and Data Security (Huge demand in tech cities like Bangalore).

- TCP (Tax Compliance and Planning): For pure tax specialists.

The Practical Reality: A Day in the Life

Role: Senior Auditor at a Big 4 Firm (Gurgaon)

It’s “busy season.” You are leading the audit for a US-based tech client. Your team is verifying their Revenue Recognition under ASC 606. You aren’t guessing; you are requesting contracts, verifying that services were actually delivered, and checking if they recorded revenue in the correct quarter. You find a $500k discrepancy. You have to professionally challenge the client’s controller to explain it. You are the gatekeeper of financial truth.

Comparison: CFA vs CPA Simplified

| Category | CFA (Investment) | CPA (US) (Accounting) |

| Structure | 3 Levels | 4 Sections (3 Core + 1 Discipline) |

| Time to Complete | 2.5 – 4 Years | 9 – 18 Months |

| Difficulty | High (Volume + Depth) | Moderate–High (Technical Rules) |

| Study Hours | 300–400 per Level | 100–150 per Section |

| Focus Area | Investments, markets, valuation | Accounting, audit, tax, reporting |

| Eligibility | Final-year undergraduate | Bachelor’s + 120–150 credits |

| Pass Rates (2025) | ~39–45% (CFA Institute) | ~48–78% (AICPA) |

| Recognition | Global finance credential | Global accounting credential |

Salary Showdown: India & US

This is the data everyone asks for. Note that CFA salaries vary wildly based on performance bonuses, while CPA salaries are consistent.

India Salary Comparison (₹ INR Annual Package)

| Experience | CFA (Investments) | CPA (Accounting/Audit) |

| Entry Level | ₹6 – 10 LPA | ₹7 – 12 LPA |

| 2–4 Years | ₹10 – 18 LPA | ₹12 – 20 LPA |

| Mid-Senior | ₹18 – 35 LPA | ₹20 – 40 LPA |

| Top Roles | ₹40 – 70+ LPA | ₹40 – 60+ LPA |

U.S. Salary Comparison ($ USD Annual Package)

| Experience | CFA | CPA |

| Entry Level | $65k – $90k | $60k – $85k |

| Mid-Level | $100k – $150k | $90k – $130k |

| Senior | $150k – $250k | $120k – $200k |

| Leadership | $250k – $500k+ | $180k – $350k+ |

Rohan Sir’s Take: CPA offers a higher average starting salary in India right now because of the massive hiring volume from US firms in Bangalore, Hyderabad, and Pune. CFA salaries start lower but spike aggressively once you manage actual money.

Which One Fits Your Background?

Use this table to map your degree to the right certification.

| Background | Better Fit | Why? |

| B.Com / BBA | CPA | Strong alignment with accounting/audit subjects you already know. |

| Engineering / Non-Commerce | CFA | Strong math base helps with CFA Quant; no need to “unlearn” accounting rules. |

| MBA Finance | Both | CFA for markets roles; CPA for corporate finance roles. |

| CA / Semi-CA | CPA | Massive syllabus overlap (approx 70%). It is the quickest ROI for you. |

| Working in Audit/Tax | CPA | Direct career progression and mandatory for signing authority. |

| Working in Banking/Markets | CFA | Perfect for valuation & portfolio management skills. |

Which One Fits Your Career Goal?

| Goal | Choose | Why? |

| Investment Banking | CFA | Valuation + Markets focus. |

| Equity Research | CFA | The core domain of the syllabus. |

| Portfolio Management | CFA | Direct pathway to managing funds. |

| Accounting & Audit | CPA | The license to practice public accounting. |

| Tax / Compliance | CPA | Regulatory depth in US Tax/Law. |

| FP&A (Corporate Finance) | CPA | Aligns with internal reporting & control. |

| CFO Track | CPA | Covers the full breadth of reporting + control. |

ROI Analysis: Cost vs. Return

CFA (The Long Game)

- Cost: ₹2.5–3.5 Lakh (approx).

- Time: 3–4 Years.

- ROI Verdict: Cheaper entry cost, but slower to monetize because it takes years to become a Charterholder. The ROI comes 5-10 years down the line when you hit senior management.

CPA (The Fast Track)

- Cost: ₹3–4.5 Lakh (Exams + Evaluation + Coaching).

- Time: 9–18 Months.

- ROI Verdict: Higher upfront cost, but pays off much faster. You can start earning a global salary in under 1 year. The “Break-even” point is usually within 6 months of getting your first job.

Global Mobility: Can You Move Abroad?

This is a huge query I get: “Sir, can I move to Canada or Dubai with this?”

- CPA (US): Highly portable to countries with Mutual Recognition Agreements (MRAs).

- Canada/Australia: US CPAs often have a streamlined path to becoming a Canadian CPA or Australian CA, making immigration easier.

- Middle East: High demand in Dubai and Saudi Arabia, especially in Big 4 firms and Oil & Gas MNCs that report in US Dollars.

- CFA: Truly global. A CFA charter in Mumbai is identical to a CFA charter in New York, London, or Singapore.

- Investment Hubs: If your goal is to work in major financial hubs like Hong Kong, London, or New York, the CFA is the universal passport.

Real Success Stories

Sometimes data isn’t enough. Here are two real examples (names changed) from students I’ve counselled.

Story A: The Engineer Who Wanted Finance

- Profile: Arjun, B.Tech grad, 2 years in IT. Hated coding.

- Dilemma: Wanted to break into Finance but had zero accounting background.

- Choice: CFA.

- Why: He had strong math skills (good for CFA Quant). He didn’t need to learn “debit-credit” rules deeply; he needed to understand valuation.

- Result: Cleared Level 2, now works as a Risk Analyst at a bank in Bangalore.

Story B: The B.Com Grad Stuck in a Rut

- Profile: Priya, B.Com, 4 years in a generic “Accounts Executive” role. Salary stagnant at 5 LPA.

- Dilemma: Needed a fast salary hike and a “big brand” on her CV.

- Choice: CPA.

- Why: She already knew the basics. She just needed the global stamp. She couldn’t afford to study for 4 years.

- Result: Completed CPA in 11 months. Hired by a Big 4 US Tax team in Hyderabad at 11 LPA.

How Edumont Helps You Crack It

Whether you choose CFA or CPA, the content is tough. There is no getting around that. But the method of studying changes everything.

At Edumont, we don’t just dump textbooks on you. We’ve built a system designed for the Indian student’s mindset.

- Concept Clarity (The “Why”):

We don’t just teach you the formula for Lease Accounting; we teach you why companies try to hide leases off-balance sheets. When you understand the logic, you don’t need to memorize.

- The Edumont LMS Advantage:

The CPA exam is computer-based. If you study on paper, you will fail. Our Learning Management System mirrors the real exam interface. You practice on the exact same screen you’ll see on exam day.

- Visual Learning:

CPA and CFA concepts can be dry. We use visual summaries and practical case studies to make them stick.

Rohan Chopra, CFA, CMA & TEDx Speaker

“The Edumont LMS: Practice exactly how you’ll play on exam day.”

Caption: “24/7 Doubt Support: You never study alone.”

Final Recommendation (Straight Answer)

- If you want investment roles → CFA is clearly better.

- If you want accounting/corporate roles → CPA is clearly better.

- Highest long-term upside → CFA.

- Fastest ROI → CPA.

Your choice defines your daily work for the next decade. Choose the problems you enjoy solving.

Ready to decide with absolute clarity? Don’t guess.