CPA Exam Pass Rates 2025 — What Are Your Chances of Passing Each Section?

If you’re planning to take the CPA exam, one of the first questions you probably ask yourself is: “What are my chances of passing?”

That’s where CPA exam pass rates come in. These figures reveal at a glance the performance of the candidates in each section of the test. They can be very helpful for you to figure out your prep strategy.

You need to understand that the percentages of candidates passing are given for individual sections, not for the entire exam. A lot of candidates get it wrong when they interpret the 75-point minimum passing score as a CPA pass percentage of correct answers — it isn’t that.

With recent changes under CPA Evolution, understanding the CPA pass rate by section and trends has become even more critical. In this guide, we’ll break down the latest pass rates, explore historical trends, and give actionable tips to improve your odds of success.

How the CPA Exam is Scored & Why Pass Rates Vary

- The Uniform CPA Examination follows a scaled percentile scoring system. To pass a section, a candidate must reach a 75 percentile score, which does not mean answering 75% of the questions correctly.

- Your score reflects how you performed relative to the overall difficulty of the exam, adjusted through statistical scaling. The CPA exam uses adaptive MCQs, where the difficulty level is adjusted based on your accuracy in earlier testlets, not a fixed question standard.

- Each section consists of multiple-choice questions and task-based simulations. Guessing carries no penalty, and individual questions may carry slightly different weights across sections.

- This scoring method accounts for the fluctuation in pass rates from quarter to quarter and also allows for a high proportion of well‑prepared candidates who outperform the overall averages.

Latest Pass Rates by Section

Up to 2023, the CPA exam was structured around four traditional sections: AUD, FAR, REG, and BEC, which were basically testing the candidates on auditing, accounting, tax, and business concepts knowledge. Every candidate was required to pass the four sections within a time frame of 18 months, and the exam put a strong focus on core accounting skills, professional standards, and written communication. Note that BEC has been discontinued by the US CPA.

While this structure served the profession for decades, the evolving demands of modern accounting, especially in technology, advisory services, and specialized roles, prompted a rethink of the exam format. With the CPA Evolution model phased in from 2024, the exam now comprises three Core sections and three Discipline options.

Core Sections:

- Auditing & Attestation: auditing concepts, professional standards, and ethics

- Financial Accounting & Reporting: financial accounting, reporting standards, and analysis

- Regulation: tax concepts, business law, and professional ethics

Discipline Options:

- Tax Compliance & Planning: advanced taxation and compliance strategies

- Audit & Attestation: specialized auditing and assurance topics

- Business Analysis & Reporting: managerial accounting, business reporting, and data analysis

The statistics below are based on AICPA quarterly releases and independent aggregators.

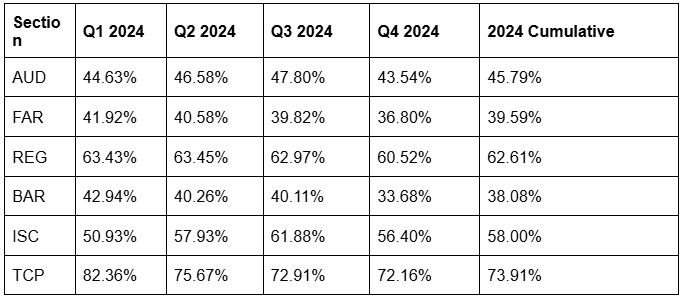

2024 CPA Exam Pass Rates (Official AICPA Data)

Note: BAR, ISC, and TCP represent Discipline sections under the new CPA Evolution model

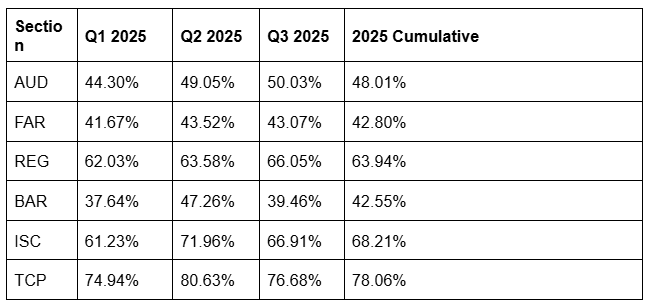

2025 CPA Exam Pass Rates (Through Q3)

Core Sections: AUD, FAR, REG

Discipline Sections: BAR, ISC, TCP

Data based on published quarterly statistics and pass rate aggregators.

What Do These Rates Mean for You?

The quarterly and cumulative pass rates for each CPA exam section in 2024 and 2025 indicate the share of candidates who attained at least 75 percentile when scored on a 0-99 scale. This is the minimum threshold for passing the exam. It should be understood that this is not equivalent to 75% of answers being correct – the score is normalized for exam difficulty and weighted by question type.

Key Insights from the Tables

- Core vs. Discipline Sections: The core sections, namely AUD, FAR, and REG, deal with fundamental accounting and auditing knowledge. In contrast, the discipline sections, BAR, ISC, and TCP, give candidates the opportunity to hone their expertise in certain specialized areas.

- Section Difficulty: FAR has the lowest pass rates most of the time, suggesting that it is the most difficult core section. On the other hand, TCP has the highest pass rates among the discipline options, which is in line with its narrower focus and the fact that it is more in tune with certain professional skills.

- Trends Over Time: Both quarterly and cumulative averages provide candidates with a better understanding of the evolution of the passing rates, which could be used for future reference, e.g. to detect the pattern of seasonal fluctuations in passing rates. Such information can be very useful in planning the exam schedule and studies.

- Interpretation: Low pass rates in a section do not mean failure is inevitable. These numbers reflect the entire candidate pool, including first-timers, repeat takers, and varying preparation levels. Strategic study, practice exams, and proper timing can significantly improve your chances.

Historical Trends & What to Learn from Them

A closer look at the success rates of CPAs in the exam over the last five to ten years can be a big help in planning for the exam and also in guiding teaching methods.

Generally, only about half of the candidates have been able to pass the exam with an average of 50-55% across all sections, thus giving insight into how tough the exam is and how different candidate’s levels of preparation are.

Major Observations

- FAR is consistently the toughest core section: Over the years, its pass rates often remain below 45%, highlighting the breadth and technical complexity of financial accounting and reporting.

- REG shows relatively stable, higher pass rates: Taxation and regulation concepts are more structured, leading to slightly higher success rates for well-prepared candidates.

- Discipline sections under the CPA Evolution model: With the shift in 2024, the exam introduced discipline options (BAR, ISC, TCP), resulting in pass rates that vary significantly depending on the candidate’s strengths and the specialization chosen. TCP generally shows the highest success rates, while BAR has historically been more challenging.

- Seasonal and quarterly fluctuations: Pass rates can vary by testing window due to differences in candidate cohorts, preparation trends, and exam difficulty adjustments.

Major Shifts & Systemic Changes

- Introduction of CPA Evolution 2024: Went from a standardized 4-section examination to a Core and Discipline model, which deeply reflects current roles in accounting.

- AICPA & NASBA updates: These governing bodies continuously refine exam content, scoring methods, and candidate guidelines to maintain professional relevance and fairness.

- Impact on study strategies: Historical trends show that candidates who align their preparation with changes in exam focus like technology application or strategically choosing disciplines, always ended up performing above the average.

- Key Takeaway: Even though the historical passing percentages highlight which areas are tougher, they serve as merely reference points, not barriers. With a well-thought-out plan, focused preparation, and the right order of taking exams can significantly improve your chances of passing even in historically challenging areas like FAR or BAR.

How to Improve Your Chances of Passing

While CPA exam pass rates may look intimidating at first glance, they represent averages—not your personal ceiling. What truly determines success is not intelligence or effort alone, but how strategically you prepare.

At EduMont, we focus on helping candidates outperform published CPA exam pass rates and AICPA CPA pass rates by giving candidates a clear edge to pass the CPA exam in one attempt by eliminating guesswork and inefficiency from the preparation process.

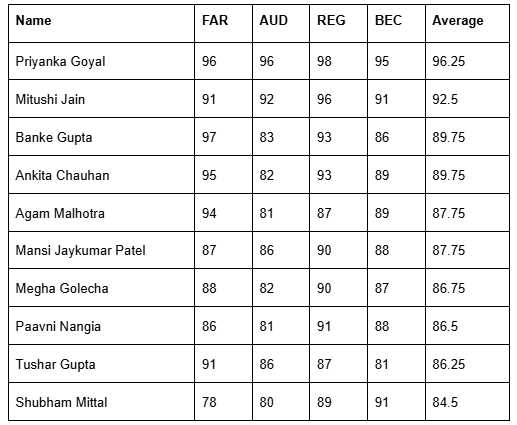

Our experience shows that candidates who follow a structured, mentor-guided system consistently outperform published pass-rate benchmarks—even in traditionally challenging sections like FAR and BAR.

How EduMont Gives You the One-Attempt Edge

AICPA-Licensed Study Material

All learning resources are aligned with the official CPA exam blueprint, ensuring candidates prepare exactly what the exam tests—nothing outdated, nothing irrelevant.

Unlimited Access to UWorld Learning Resources

Candidates receive unlimited access to UWorld printed books, eBooks, test banks, and mock exams, allowing them to practice, revise, and test themselves continuously until they pass. UWorld is regarded as one of the best CPA study materials in India.

Live Chalk-and-Talk Classes

Interactive live sessions focus on conceptual understanding, exam logic, and real-time doubt resolution—replicating the discipline and clarity of a classroom environment.

Access-Till-You-Pass LMS Support

EduMont’s in-house LMS provides pre-annotated and highlighted study material, structured class notes, and recorded sessions, all accessible until you clear your exams.

Certified, Faculty-Led Training

Training is led by experienced CPA and CMA professionals, including mentors such as CPA/CMA and TEDx speaker Rohan Chopra, along with expert CPA faculty like Shubham Shandilya and Parth Zaveri, ensuring instruction goes beyond theory into exam application.

Safety Net System for Exam Readiness

EduMont’s Safety Net System tracks progress through assessments, performance reviews, and mentor interventions—ensuring candidates attempt each CPA section only when they are exam-ready, not prematurely.

Personalised One-on-One Game Plan Calls

Dedicated mentorship sessions evaluate preparation levels, fine-tune exam strategies, and identify last-mile gaps—significantly reducing the risk of retakes.

Pass-in-One-Attempt Guarantee

Backed by the Game Plan Call evaluation system, this reflects EduMont’s confidence in its preparation process and readiness assessment.

End-to-End Enrolment & Career Support

From US CPA eligibility checks and evaluation to exam scheduling, licensing guidance, and career support, EduMont provides complete hand-holding across the CPA journey.

No-Cost EMI & Flexible Payment Options

Financial flexibility ensures that access to world-class CPA preparation is never limited by cost constraints.

EduMont’s Top 2025 CPA Pass Rates

What Our Students Are Saying?

Pass Rates Inform – Preparation Determines Results

CPA exam pass rates offer valuable insight into section difficulty and overall trends, including CPA pass percentage, CPA pass rate by section, and 2025 CPA pass rate, but they do not define your individual chances of success. What ultimately matters is a well-structured preparation strategy that aligns with the CPA Evolution exam model, scoring methodology, and your personal readiness for each section.

At EduMont, candidates are guided with AICPA-licensed study material, expert-led training, continuous readiness tracking, and personalised game-plan mentoring, ensuring you attempt each section only when you’re truly prepared to clear it in one attempt.

Ready to plan your CPA journey the right way?

Book a free CPA counselling session with EduMont to get a personalised study roadmap, eligibility check, and a clear strategy to pass the CPA exam confidently.

Frequently Asked Questions

- How hard is the CPA exam pass rate?

A. The CPA exam is considered challenging, with average section pass rates typically ranging between 40–65%, depending on the section and year. - What is the minimum passing score for the CPA Exam?

A. Candidates must achieve a scaled percentile of 75 (not 75%) on a 0–99 performance scale to pass any CPA exam section. - Why are pass rates for some sections much lower than others?

A. Pass rates vary by section due to differences in content breadth, technical complexity, exam structure, and candidate preparedness. - Do these pass rates apply to first-time takers or repeat takers?

A. Published CPA exam pass rates include both first-time and repeat test-takers, reflecting the overall candidate pool. - Can I compare pass rates across years despite exam changes?

A. Yes, pass rates can be compared for trend analysis, but structural changes like CPA Evolution should be considered when interpreting differences. - How soon after sitting for the exam will I know the results?

A. CPA exam results are generally released within a few weeks of the testing window, as per AICPA score release timelines.