What if you could earn a global finance credential that boosts your salary, opens international career opportunities, and makes you future-ready in the era of AI, automation, and digital finance? Welcome to the US CMA course and a globally respected credential in management accounting, awarded by the Institute of Management Accountants (IMA), USA. Whether you’re a finance student, a working professional, or someone feeling stuck in a stagnant career, the CMA could be the game-changer you’re looking for.

US CMA Course 2025: Eligibility, Fees, Syllabus & Salary in India

The US CMA (Certified Management Accountant) is a professional certification recognized across 100+ countries. It validates your expertise in:

- Management accounting

- Strategic financial management

- Corporate finance

- Decision-making and analytics

It’s no longer just about number-crunching. Today, Certified Management Accountant professionals are expected to use financial intelligence to drive business strategy and organizational success. Think of it as a powerful combination of accounting, finance, analytics, and business leadership ;”> all rolled into one.

Why Choose the CMA in 2025 ?

In 2025, companies increasingly demand finance professionals who can blend accounting with analytics, automation, AI tools, ERP systems, and digital finance skills. CMAs fit this requirement perfectly

- Interpret data

- Manage risks

- Forecast business outcomes

- Align finance with long-term strategy

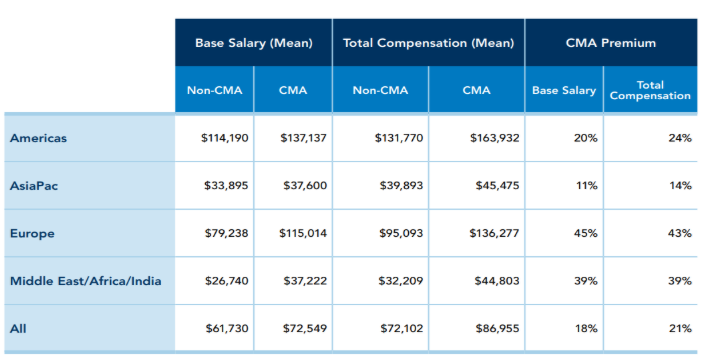

This is where CMAs shine. They bring both analytical skills and strategic insights. According to the According to the latest 2024 IMA Global Salary Survey, CMAs globally earn 58% more than their non-certified peers. But beyond salary, the certification offers:

- Credibility

- Global mobility

- Career progression

US CMA Eligibility Criteria 2025

In 2025, many students begin CMA preparation as early as the 1st or 2nd year of college, though exams can only be taken in the final year

- A bachelor’s degree (in any discipline; completed or in final year)

- 2 years of relevant work experience (can be earned before or after passing exams)

- Active IMA membership

- Bonus: Final-year undergrads can register and take the exams.

US CMA Fees in India (Total Cost Breakdown)

Here’s the updated 2025 US CMA Exam fee in India, including IMA charges and coaching fees (fees increased 8–10% in 2024–2025)

- Students: ₹1.2L to ₹1.8L

- Professionals: ₹1.8L to ₹2.5L

CMA Salary in India & Globally

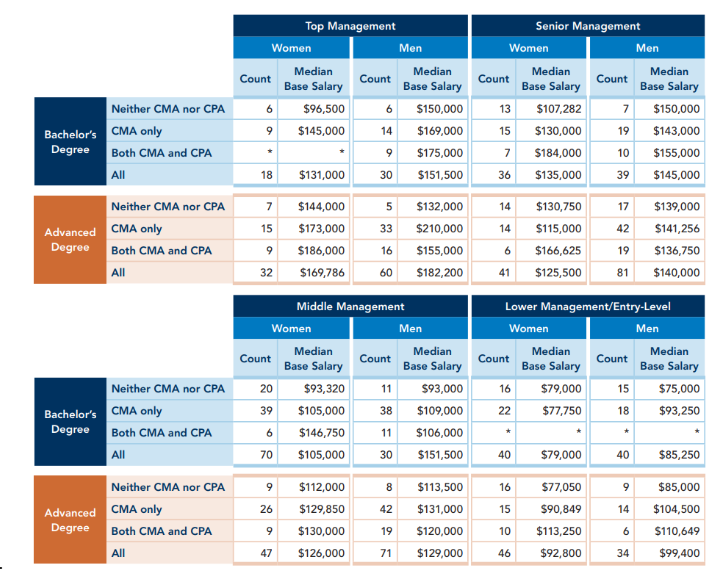

The latest IMA survey reveals compelling compensation trends:

- 21% higher total compensation globally vs. non-CMAs

- In India, Middle East & Africa, they earn 39% more on average

- In the Americas, the difference is 24%

- Gen Z and younger professionals reported salary premiums of up to 41%

Average US CMA Salary in India (2025): ₹7 to 12 LPA

Global Roles (US or Gulf): ₹28 to 35 LPA+ in 2025

What About ROI? (Cost vs Salary)

Let’s break it down:

- Total Cost (including training, IMA fees, and exam): ₹1.2L to ₹2.5L (approx.)

- Average Salary After CMA in India: ₹6L to ₹10L

- US or Gulf Placement? ₹25L+ in global roles

US CMA Syllabus: Course Structure & What You’ll Study

The US CMA syllabus is divided into 2 parts, both focused on practical skills.

Part 1: Financial Planning, Performance & Analytics

- Cost management

- Budgeting and forecasting

- Performance management

- Internal controls

- Data analytics

Part 2: Strategic Financial Management

- Corporate finance

- Risk management

- Investment decisions

- Financial statement analysis

- Ethics and professional conduct

CMS Duration: Most students complete the CMA course in 6 to 12 months with dedicated preparation.

CMA Career Opportunities: Where Can You Work?

The CMA certification opens doors to global roles across sectors:

Top Job Roles

- FP&A Analyst

- Cost Accountant

- Risk Consultant

- Business Controller

- Finance Manager

- CFO (long-term goal!)

Top Employers

Big 4s, MNCs, Tech & Consulting firms:

- Deloitte

- EY

- Amazon

- Capgemini

- Wipro

- Cognizant

- Accenture

Plus, you’ll find CMAs in startups, NGOs, and even government bodies.

Is the US CMA Exam Difficult?

Honest answer: Challenging but doable.

- Global Pass Rate: 45–50%

- Recommended Study Hours: 250–300 hours

- Exam Format: MCQs + Essays (No negative marking)

The key to success? Strong conceptual clarity, mentorship, mock tests, and consistency.

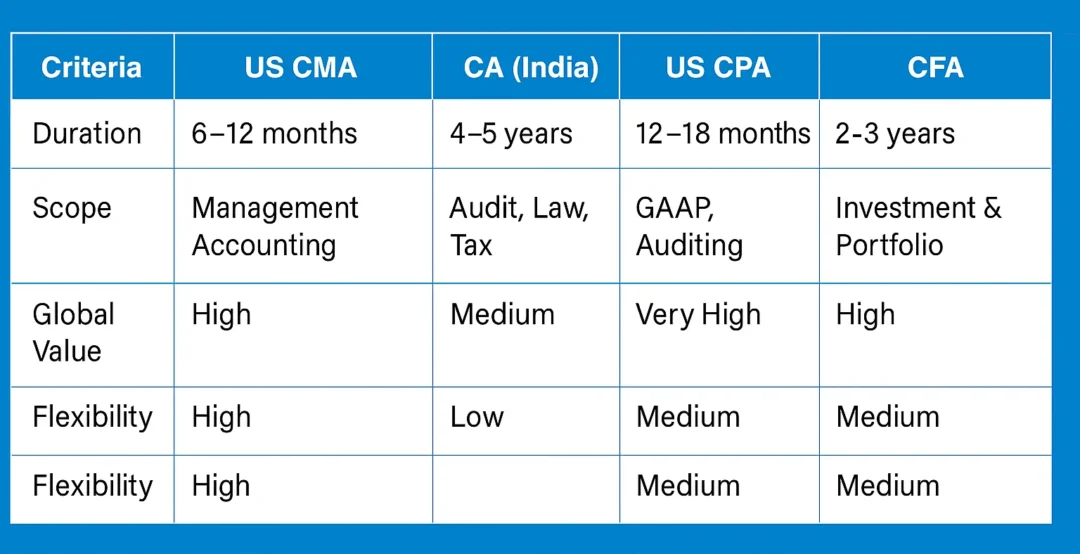

CMA vs CPA vs CA vs CFA: Which is Better for You?

If you want a globally valued, fast to track finance qualification, CMA strikes the perfect balance

How to Start Your US CMA Journey?

- Choose an IMA-approved training partner (check for job support & mentoring)

- Register on the official website

- Book your exam at Prometric centers across India

- Study consistently—mock tests and mentor feedback are your best friends

Final Verdict: Is CMA USA Worth It?

If you:

✅ Love working with numbers & strategy

✅ Want global career options

✅ Seek a fast-track certification

✅ Aim for a strong salary jump

Then yes, CMA is 100% worth it.

This credential doesn’t just prepare you for the finance industry of today—it equips you for the future. A future where data-driven decisions, analytics, and business acumen matter more than just number crunching.