US CPA Exam Syllabus 2026: Complete Guide to Core Sections and Disciplines

The US CPA exam is a gateway to a prestigious and rewarding career in accounting and finance. However, understanding the syllabus can be overwhelming if you don’t have the right guidance. This comprehensive guide will break down each section, explain the detailed chapters for FAR, REG, and AUD, and introduce you to how EduMont’s study materials and the UWorld portal can make your preparation journey smoother and more effective.

How is the US CPA exam structured, and what topics are covered in each section?

The US CPA exam is divided into three main sections:

1.Financial Accounting and Reporting (FAR)

The FAR section is considered one of the most comprehensive and challenging parts of the US CPA exam. It focuses on financial reporting frameworks used by various entities, including governments, public companies, and non-profit organizations. The content is detailed, covering various financial accounting topics.

FAR Chapters Breakdown:

Chapter 1: Conceptual Framework and Financial Reporting

Financial statements and their components

Recognition, measurement, valuation, and disclosure

Chapter 2: Financial Statements of Non-Governmental Not-for-Profit Organizations

- Characteristics of not-for-profit entities

- Financial reporting requirements

Chapter 3: Financial Statements for State and Local Governments

- Fund accounting principles. Government-wide and fund financial statement

Chapter 4: Financial Statement Accounts

- Detailed study of assets, liabilities, equity, revenues, and expenses Concepts related to inventories, investments, leases, income taxes, pensions, and contingencies

Chapter 5: Revenue Recognition and Contracts with Customers

- Understanding the revenue recognition principles under ASC 606

Chapter 6: Fixed Assets and Intangible Assets

- Accounting for property, plant, equipment, depreciation, amortisation, and impairment

Chapter 7: Long-term Liabilities and Bonds

- Accounting for bonds, leases, and long-term liabilities

Chapter 8: Business Combinations and Consolidated Financial Statements

- Consolidation process, intercompany transactions, and financial reporting

Chapter 9: Foreign Currency Transactions and Translation

- Currency exchange, hedging, and foreign financial statement translation

Chapter 10: Derivatives and Hedge Accounting

- Understanding derivative instruments, risk management, and accounting

Chapter 11: Income Taxes and Deferred Tax

- Current and deferred tax calculations, valuation allowances, and disclosures

Chapter 12: Statement of Cash Flows

- Preparation, classification, and understanding cash flow statements

2. Regulation (REG)

The REG section focuses on business laws, ethics, federal taxation, and regulations affecting businesses and individuals. This section ensures that candidates understand the legal framework and taxation policies. Here’s a chapter-wise breakdown of REG:

REG Chapters Breakdown:

Chapter 1: Ethics, Professional Responsibilities, and Federal Tax Procedures

- Understanding professional responsibilities and the AICPA Code of Conduct

- Circular 230 regulations and IRS procedures

Chapter 2: Business Law and Contracts

- Agency, contracts, sales, and secured transactions

- Bankruptcy laws and debtor-creditor relationships

Chapter 3: Federal Taxation of Individuals

- Gross income, deductions, credits, and filing requirements

- Calculation of individual taxable income and tax liabilities

Chapter 4: Federal Taxation of Property Transactions

- Realized and recognized gains/losses, property basis, and depreciation

- Like-kind exchanges and installment sales

Chapter 5: Federal Taxation of Entities

- Taxation of C corporations, S corporations, partnerships, and LLCs

- Formation, operation, and liquidation of entities

Chapter 6: Tax-Exempt Organizations

- Types of tax-exempt organizations and filing requirements

- Unrelated business income (UBI) and excise taxes

3.AUD – Auditing and Attestation

The AUD section covers auditing processes, internal controls, and professional ethics. It’s crucial for those aiming to understand how audits are conducted and how to analyze financial statements.Here’s a breakdown of the chapters that AUD subject entails:

AUD Chapters Breakdown:

Chapter 1: Ethics, Professional Responsibilities, and General Principles

- AICPA Code of Professional Conduct

- Sarbanes-Oxley Act and PCAOB standards

Chapter 2: Assessing Risk and Developing a Planned Response

- Understanding the client, industry, and internal controls

- Audit risk and materiality

Chapter 3: Performing Further Procedures and Obtaining Evidence

- Audit sampling, substantive procedures, and analytical procedures

- Internal controls testing and fraud detection

Chapter 1: Ethics, Professional Responsibilities, and General Principles

- AICPA Code of Professional Conduct

- Sarbanes-Oxley Act and PCAOB standards

Chapter 2: Assessing Risk and Developing a Planned Response

- Understanding the client, industry, and internal controls

- Audit risk and materiality

Chapter 3: Performing Further Procedures and Obtaining Evidence

- Audit sampling, substantive procedures, and analytical procedures

- Internal controls testing and fraud detection

Chapter 4: Forming Conclusions and Reporting

- Audit reports, reviews, compilations, and attestation engagements

- Modifications to the audit report and communication with stakeholders

What About the Latest Updates In The US CPA Syllabus?

There have been several changes and updates to the US CPA syllabus in recent years. Here are some key updates:

Content Updates: The American Institute of Certified Public Accountants (AICPA) regularly reviews and updates the CPA exam content to reflect changes in the accounting profession, standards, and regulations. Recent updates have incorporated topics related to emerging technologies, sustainability, and data analytics.

Integration of Technology: The CPA exam now includes a focus on technology and its impact on accounting processes. This includes understanding software applications, cybersecurity, and data management practices.

Increased Emphasis on Professional Skepticism: The AICPA has emphasized the need for candidates to demonstrate professional skepticism, particularly in the Auditing and Attestation (AUD) section. This is to ensure that future CPAs are prepared to critically assess audit evidence and make informed judgments.

Exam Format Changes: The CPA exam has seen updates in its structure and format, including the introduction of new question types such as task-based simulations and the use of multiple-choice questions designed to test higher-order thinking skills.

Introduction of the CPA Evolution Model: Starting in 2024, the CPA exam will transition to a new model known as CPA Evolution. This model aims to reflect the changing role of CPAs and will introduce new content areas that align with current industry practices.

Focus on Diversity, Equity, and Inclusion (DEI): Recent updates have also recognized the importance of DEI in the accounting profession, prompting changes in the exam to ensure that candidates are aware of these issues.

It’s crucial for aspiring CPAs to stay informed about these updates and incorporate the latest syllabus changes into their study plans to ensure they are well-prepared for the exam.

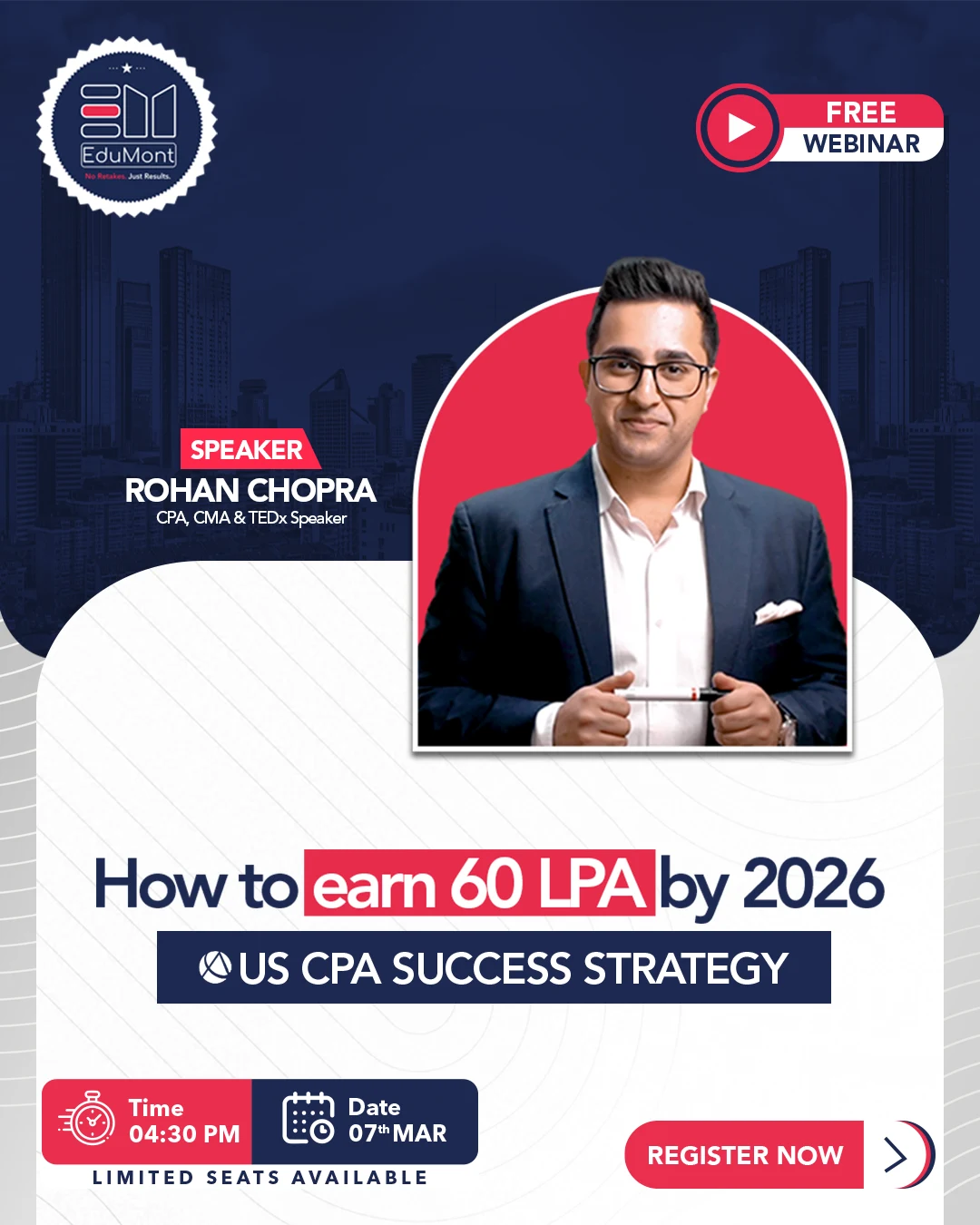

Why Choose EduMont?

By choosing EduMont, you’re not just preparing for an exam; you’re investing in a learning experience that equips you with the knowledge, skills, and confidence to succeed in your CPA journey.

Expert Faculty: EduMont offers guidance from experienced and highly qualified instructors who understand the complexities of the CPA exam. They provide in-depth explanations, practical insights, and tips to help you grasp even the most challenging concepts with ease.

CPA Study Materials: Our CPA preparation package includes well-structured EduMont books, which break down each topic in simple terms, ensuring you understand the syllabus thoroughly. Additionally, our Learning Management System (LMS) offers engaging video lectures, quizzes, and interactive resources to help you study effectively.

UWorld Practice Portal Access: We provide access to the UWorld portal, which is a top-rated CPA exam practice tool. It offers thousands of exam-style questions with detailed explanations, helping you build confidence and identify areas that need improvement.

Flexible Learning Options: With EduMont, you can learn at your own pace. Our online platform is accessible 24/7, allowing you to fit your CPA schedule around your busy life.

Regular Mock Tests and Performance Tracking: To ensure you’re exam-ready, we conduct regular mock tests that simulate the actual CPA exam environment. This helps you evaluate your progress and fine-tune your preparation.

Personalized Support :At EduMont, we believe in guiding you throughout your CPA journey. Our support team and instructors are always available to answer your questions, provide feedback, and offer personalized study plans.

Proven Track Record:EduMont has a history of helping students pass the CPA exam with flying colors. Our success stories speak volumes about the quality of our training and support.

Conclusion:-

The US CPA exam syllabus is comprehensive, but with the right guidance and resources, you can conquer it successfully. By covering each chapter in detail and offering study support, EduMont ensures you’re well-prepared for the CPA journey. Invest in your future with EduMont and start your path to becoming a Certified Public Accountant today.