US CPA / CMA Classes by

Rohan Chopra

CPA, CMA, TEDx

Speaker

India's Best Coaching For

Certified Public Accountant (US CPA) &

Certified Management Accountant (US CMA) Course

- Globally Accredited Designations

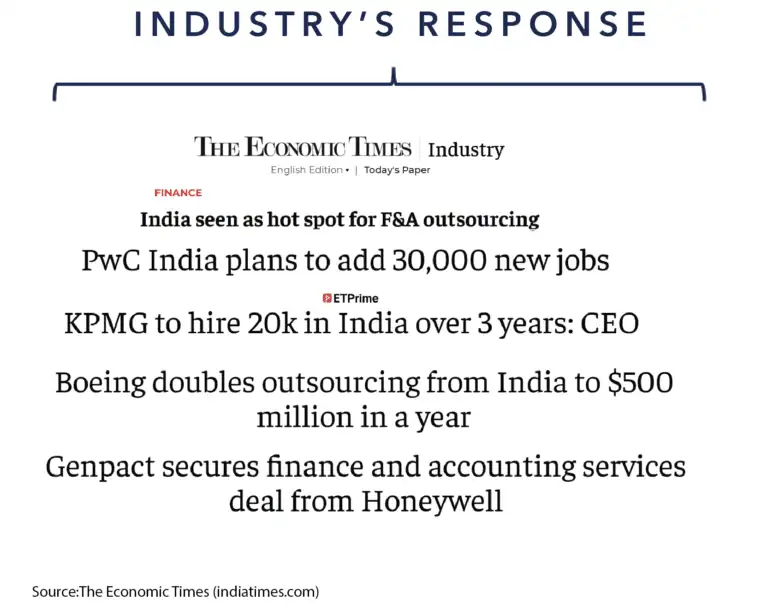

- Global Accountant Shortage = Increased Scope of CPAs & CMAs in India

- INR 10-12 LPA Starting CPA Salary

- INR 6-8 LPA Starting CMA Salary

- AICPA Approved CPA Study Materials

- IMA Approved CMA Study Materials

- Unlimited Access with Auto Updates

- Pass in 1 Attempt Guaranteed

Highest Student Satisfaction in India

India's Best Coaching For

Certified Public Accountant (US CPA) &

Certified Management Accountant (US CMA) Course

- Globally Accredited Designations

- Global Accountant Shortage = Increased Scope of CPAs & CMAs in India

- INR 10-12 LPA Starting CPA Salary

- INR 6-8 LPA Starting CMA Salary

- AICPA Approved CPA Study Materials

- IMA Approved CMA Study Materials

- Unlimited Access with Auto Updates

- Pass in 1 Attempt Guaranteed

Highest Student Satisfaction in India

US CPA / CMA Classes by

Rohan Chopra

CPA, CMA, TEDx

Speaker

Choose Your Career Path

Our Top Results

An Applause For Our Top Performers..

Official US CPA Study Material Partner

Official US CMA Study Material Partner

US CPA & CMA Course at EduMont

Upcoming Webinar

This Saturday to

4:30PM

New Batch Starts on

6th April 2025

For CPA & CMA

Chalk & Talk Classes

Rated India's Best

LIVE CPA TRAINING

AICPA & IMA Approved

Studay Materials with

Unlimited Access

Upcoming Webinar

This Saturday to

4:30PM

New Batch Starts on

09th February 2025

For CPA & CMA

Chalk & Talk Classes

Rated India's Best

LIVE CPA TRAINING

AICPA & IMA Approved

Studay Materials with

Unlimited Access

Global Shortage of CPAs & CMAs = Increased Scope in India

World’s best CPA Faculties Under 1 roof

Pass in 1 Attempt with us!

Roger Philipp,

CPA, CGMA,

Chief Creative Officer

@ UWorld

Rohan Chopra,

CPA, CMA,

TEDx Speaker, Lead Faculty

@EduMont

Peter Olinto,

CPA, CFA,

Global Lead Instructor

@ UWorld

Why EduMont ?

No. 1

People’s Choice

for CPA Classes

AICPA

Approved

Study Material

Unlimited Access

with

Auto Update

Individualized

Attention

& Support

Pass in

1 attempt

Guarantee

Personalized

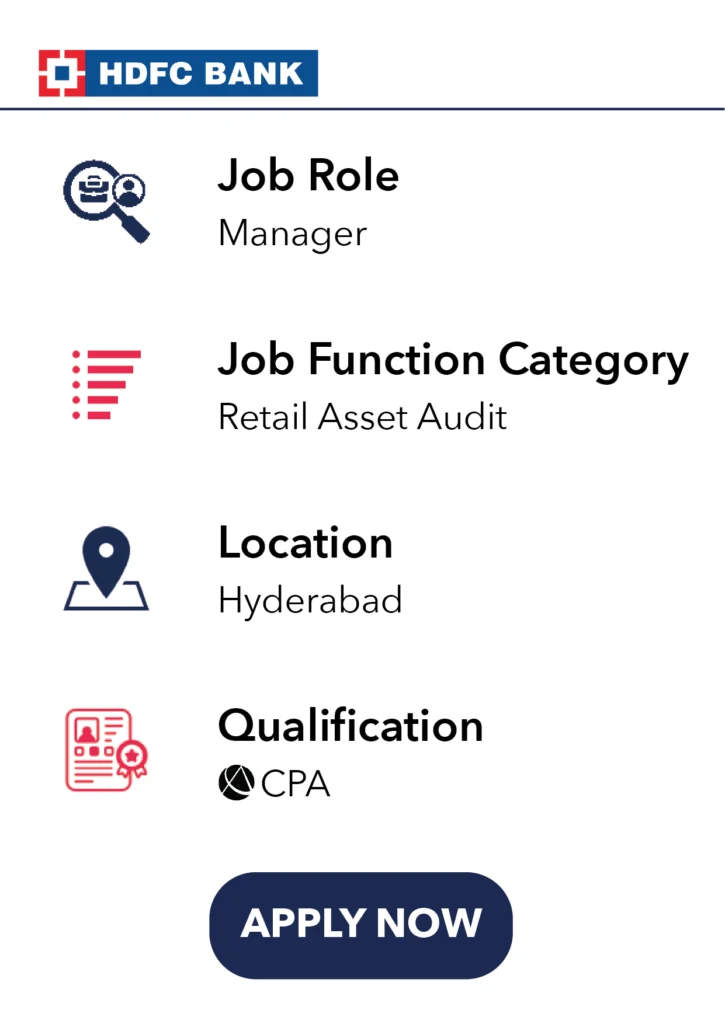

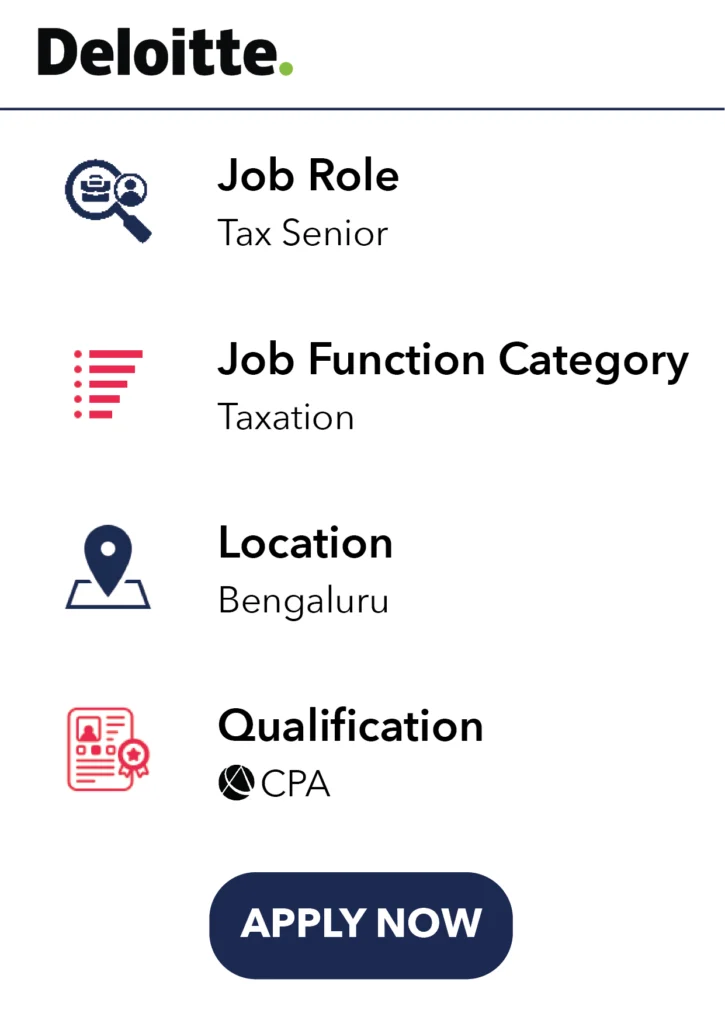

Placement

Assistance

Parameter

dsfsdfzcxcdsafdsfsdf

- Unlimited Access (classes & materials)

- World Class-Study Material

- World Class-Test Bank

- Pre-Highlighted Additional Notes

- Live Whiteboard Classes

- Live OTB Classes

- Recorded Lectures

- Audio Video Book Lectures

- Eligibilty Assistance

- Evaluation Assistance

- Free Experience Verification

- License Assistance

- Dedicated Quick Doubt Resolution

- Qualified Full Time Faculty

- In-House Placement Assistance

- Placement Agency tie-ups

- Placement Agency tie-ups

Fees

EduMont

CALL NOW

M***s Educatio

- Local Materials

- Local Materials

- High follow up time

Rs.1,04,000

S**d**r Education

- High follow up time

Rs.1,15,000

Others

- Local Materials

- Local Materials

- Local Materials

- No Support faculty

-----------

Launch Your Career With EduMont

Also Seen On

Frequently Asked Questions ?

Why is the US CPA course in high demand?

‘US CPA’ (Certified Public Accountant) is a highly sought-after designation because not only is it recognized in most countries around the globe – including the US, Canada, and Australia but also because experienced US CPAs tend to climb the corporate ladder relatively easily due to the practical & industry-focused content of the US CPA curriculum.

What is the scope of US CPA in India?

The scope of US CPA (Certified Public Accountant) in India is primarily focused on international accounting and finance roles. US CPAs are sought after by multinational corporations, audit firms, and financial institutions operating in India for their expertise in U.S. GAAP and international accounting standards, as well as their ability to navigate complex financial regulations and compliance requirements.

What is the US CPA Course Duration in India?

US CPA Course has a usual run-time of 1 year i.e. 12 months for most people. If you are a full-time student, you may be able to complete the US CPA training & exams in less than a year. For working professionals who may not be able to dedicate study time on a daily basis, completing US CPA can take up to 18 Months or 1.5 years.

What are the 4 US CPA Subjects/ What is the US CPA Subjects list?

Starting Jan 1, 2024, the US CPA exam follows a 3+1 pattern i.e. 3 core subjects and 1 elective specialization. The core US CPA subjects are 1. AUDIT & ATTESTAION; 2. US TAX REGULATION & BUSINESS LAWS; 3. FINANCIAL ACCOUNTING & REPORTING.

What is the starting US CPA US Salary in India?

The average starting salary for US CPAs in India is INR 8-10 LPA, based on US CPA License Application status, location and employer.

Is there a US CPA exam schedule or what are the US CPA exam dates?

US CPA Exams are on-demand and do not follow a fixed schedule. Exams are available all year round in India and you can be scheduled in any order on any day (except public holidays) based on your preferences and preparation level at a time slot of your choice.

Where are the US CPA Exam centres in India?

US CPA Exams are conducted at Prometric Centres located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum, in India.

Will EduMont help me select a suitable State Board of Accountancy?

Yes, while our US CPA online course helps you understand the ins and outs of the exam, our academic team will also help you select a State Board of Accountancy most appropriate for you.

Do EduMont's US CPA classes cover all four US CPA exams?

Yes, our online US CPA coaching trains you for all four exams – Audit, Financial Accounting & Reporting, Regulation, and Business Environment & Concepts. Moreover, our comprehensive US CPA USA course also comes with unlimited access to Wiley study material.

How is US CPA Coaching at EduMont different?

At EduMont, we offer you complete transparency in everything; be it information about the US CPA course, duration, US CPA exam fee, syllabus or the registration process.

What is the purpose of the US CPA Certification?

The purpose of the US CPA (Certified Public Accountant) certification is to ensure that professionals in accounting and finance possess the knowledge, skills, and ethical standards required for roles in auditing, financial reporting, taxation, and consulting. It signifies a high level of expertise, credibility, and adherence to professional standards in the field of accounting.

How can I get the New US CPA Syllabus of 2025?

You can get access to the 2025 US CPA Syllabus and all the necessary updates on the US CPA Evolution Model at the NASBA & AICPA websites or simply google AICPA Exam Blueprints and download the pdf from official AICPA website.

Which is the best live US CPA Review Classes near me?

EduMont provides comprehensive & interactive live CPA classes, quick doubt resolution, AICPA Approved CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

Which are the best US CPA Books in India or Which are the best study materials for US CPA Exam?

AICPA Approved Study Materials are the best choice for students wanting to clear the US CPA Exam in 1 Attempt. Approved content goes thorough rigorous quality checks by AICPA and conform with the official US CPA Syllabus. AICPA Approved content also auto updates with the latest topics once they are released and added to the US CPA syllabus by AICPA. There are only 5 Approved Study Materials: UWorld, ROGER’s, Surgent, Beckers & Gliem, any other providers/names, are not approved by AICPA (no matter what they say or advertise). Please beware!

Is S**d**r Education US CPA better than EduMont?

EduMont provides comprehensive & interactive live US CPA classes, quick doubt resolution, AICPA Approved US CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian US CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

Is M***s Education US CPA Review better than EduMont?

EduMont provides comprehensive & interactive live US CPA classes, quick doubt resolution, AICPA Approved US CPA study materials with unlimited access and ‘Pass in 1 Attempt’ guarantee. All these features do not exist in the offering of any other Indian US CPA Institute, making EduMont the uncontested best choice for students. Please refer to the comparative table above for a more comprehensive comparison.

Are UWorld US CPA Books better than Becker’s US CPA in India?

UWorld CPA Excel is an Approved US CPA Study Material, as is the Beckers US CPA Package & Review. Both have the similar content of equal quality. However, while Becker’s in India comes with limited access only, whereas WILEY comes with unlimited access as standard. This means with Beckers there are hidden charges for renewal fees everytime your access needs to be renewed. But with WILEY, you own the US CPA study materials till you become a US CPA, with no renewal fee/hidden charges and automatic over the air updates for future syllabus changes. Given these facts WILEY is clearly the wiser choice.

Where all does EduMont Provide US CPA Coaching in India?

The following areas are serviceable at EduMont: US CPA classes in Delhi, US CPA classes in Noida, US CPA classes in Mumbai, US CPA classes in Pune, US CPA classes in Hyderabad, CPA classes in Ahmedabad, US CPA classes in Bangalore and all other major cities across India. Our students trust us for US CPA Coaching in Delhi, US CPA Coaching in Noida, US CPA Coaching in Mumbai, US CPA Coaching in Pune, US CPA Coaching in Hyderabad, US CPA Coaching in Ahmedabad, US CPA Coaching in Bangalore and all other major cities across India.

How much is the US CPA Exam Fees in India or What is the total US CPA Registration Fee in India or What is the US CPA Cost in India?

The total cost of doing US CPA in India (including US CPA Registration Fees in India, AICPA Approved study materials, coaching and all the necessary US CPA Exam Fees) is INR 3,45,482. For a more detailed breakdown of the costs refer to the CPA Fee section above.