Aspiring to become a US CPA? Before you take the next step, first check if you meet the US CPA course eligibility criteria. At EduMont our expert guidance, helps you to qualify with confidence. This will help you focus on the CPA syllabus, and passing the exam, instead of getting stuck, figuring out the requirements!

Why US CPA Eligibility Matters?

Most importantly, it ensures that you sit for the US CPA Exam with world class study material

In addition, it helps you choose the right state board (as eligibility varies)

As a result, it saves time and money by avoiding unnecessary course work

US CPA Course Eligibility Check

Eligibility Requirements For US CPA Exam

1. Credits Required

To appear for the exam, candidates must complete a minimum of 120 credits. In addition, they need 24 or more credits in accounting.

2. General Rule

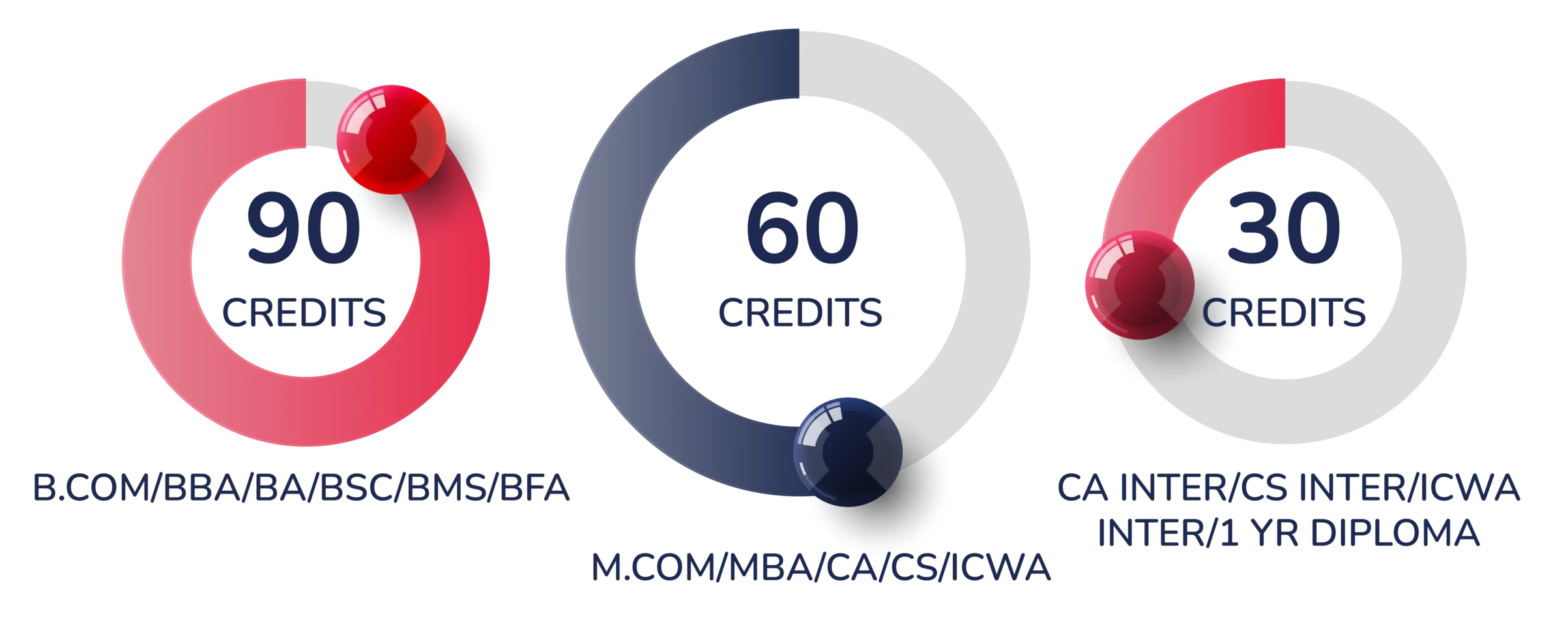

30 credits per year in University education in India. Eg: 1 year = 30 credits : B.Com → 3 year x 30 credits = 90 credits

3. Remaining Credits

The remaining credits can be covered by taking up relevant bridge courses

4. Exception Rule

Candidates who have earned 8 or more subject-specific credits in Accounting, Business, or Economics are eligible to sit for the CPA Exam. Moreover, even if they have only completed 90 overall credits.

Credits Required

To appear for the exam, candidates must complete a minimum of 120 credits. In addition, they need 24 or more credits in accounting.

General Rule

30 credits per year in University education in India. Eg: 1 year = 30 credits : B.Com → 3 year x 30 credits = 90 credits

Remaining Credits

The remaining credits can be covered by taking up relevant bridge courses

Exception Rule

Candidates who have earned 8 or more subject-specific credits in Accounting, Business, or Economics are eligible to sit for the CPA Exam, even if they have only completed 90 overall credits.

US CPA Eligibility Requirements For License

Clearing all 4 Exams

Having 150 Credits

A minimum of 1 year of work experience

Licensed CPA verification required

Clear the Ethics Exam

Clearing all 4 Exams

Having 150 Credits

A minimum of 1 year of work experience

Licensed CPA verification required

Clearing the Ethics Exam

Indian Student’s Degree Credits For US CPA Eligibility

Do I Need A Bridge Course For CPA?

Do I Need A Bridge Course For CPA?

Bridge Courses are supplementary, easy-to-complete NAAC-accredited courses designed to help you meet your eligibility requirements if you haven't already done so. These courses may be required if:

Lacking the 8+ ABE Credits

Currently, you do not meet the requirement of 120 credits

You do not have the required 150 credits.

Get Your Personalized CPA Eligibility Report

Get Your Personalized CPA Eligibility Report